2. W-2 and 1099 Preparation

3. E-Filing

4. Tax Planning & Consulting

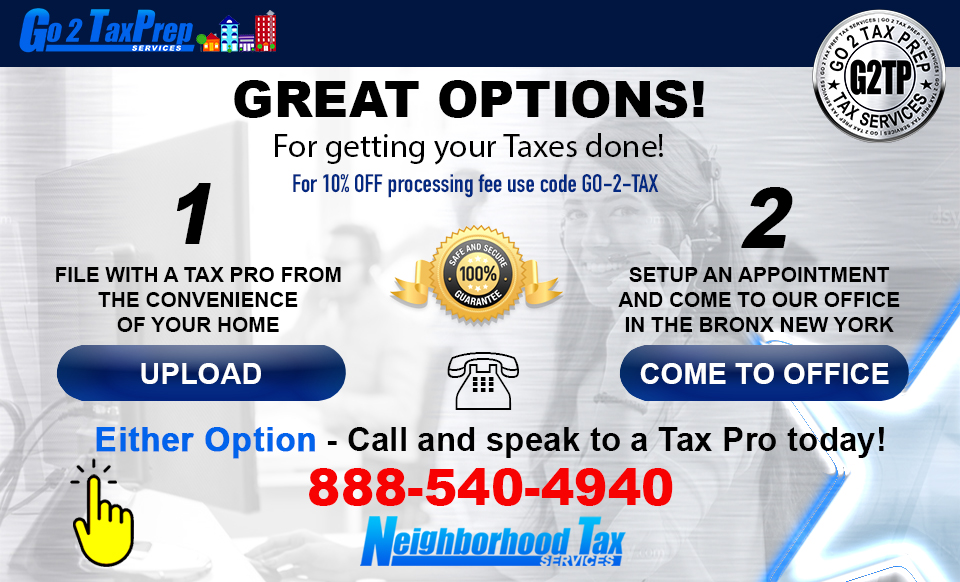

5. Contactless Tax Prep Bi-Lingual

1. Up-to $250! (Virtual Clients Only)

2. Up-to $1000 in interest freeCash

Advancement from your tax return. Pathward Bank determines eligibility.

- Planning and scheduling your business.

- Doing research for your clients

- Create and manage business process

From the moment I reached out to Neighborhood Tax Services, John Bolden made the

often intimidating world of taxes feel accessible and manageable.

The results speak for themselves: maximized returs and minimized stress. ~ D. K. ~

John Bolden’s personal touch and vast knowledge of the tax code has saved my business

countless hours and money. Neighborgood Tax Services,

LLC isn’t just a tax advisor, they’re a trusted partner in my financial journey. ~ S. L. ~

Navagating tax matters has always been overwhelming for me. But thanks to

John and the team at Neighborhod Tax Service, LLC I feel confident

and secure that every detail is handled with care. Their service

is unparalleled and worth every penny. ~ A. W. ~

I used to dread tax season until I discovered Neighborhood Tax Services.

John Bolden’s thoroughness, precision, and understanding of my unique tax

needs have made all the difference. I can’t thank him enough for the peace of mind he’s provided. ~ J. R. ~

drive innovation and spur economic growth.